23+ j1 visa tax calculator

Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation. For foreign seasonal workers these three figures are zeroes.

The Complete J1 Student Guide To Tax In The Us

Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like.

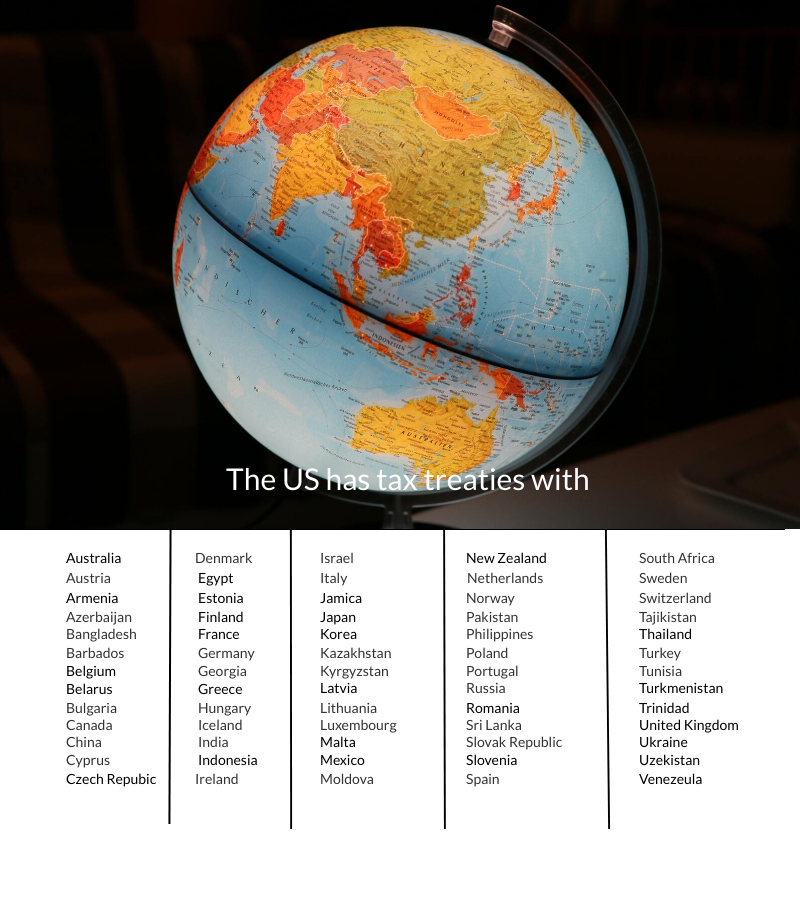

. Then just mail it in. Web J-1 visa holders are entitled to claim tax refunds on both federal and state taxes. Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator.

To do that file your tax return. Web There are different J-1 visa tax rates depending on factors such as your income. 20 to file it.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Web As a J-1 visa holder you are considered as a non-resident for the first two years since you entered the US. Its hard to say how long itll take for you to get your.

Web These are usually 62 for Social Security up to 62 for Federal Unemployment and 145 for Medicare. Web For tax filing purposes most J-1 visa holders are considered Nonresident Aliens. Ad Our Free Tax Calculator Is a Great Way to Learn about Your Tax Situation.

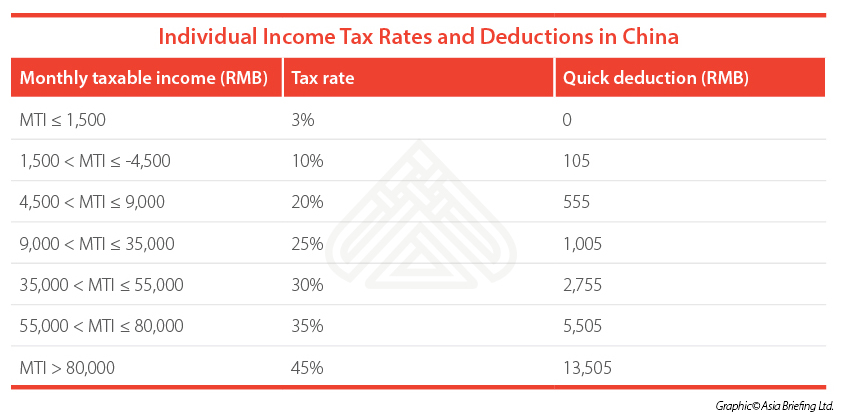

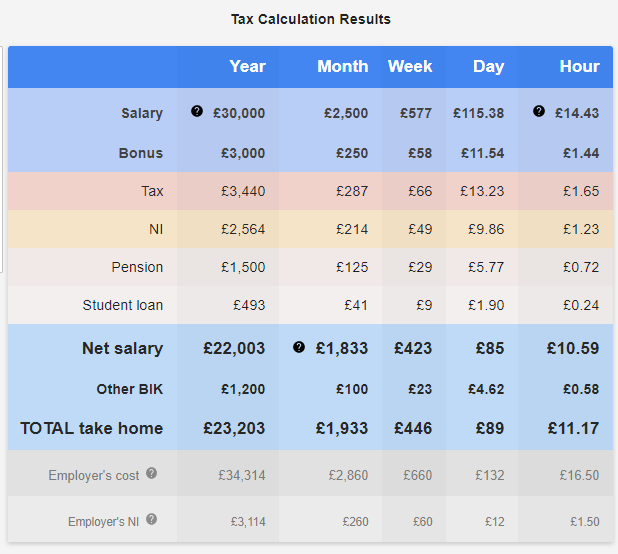

The results are only estimates however as various other factors. Web OPT as well as individual students are taxed on their wages at graduated rates from 10 to 396 it depends on your income level. Number of nonexempt days in United States during 2022.

Web Use this free tax return calculator to estimate how much youll owe in federal taxes using your income deductions and credits in just a few steps. Web Our income tax calculator calculates your federal state and local taxes. Web To determine whether W met the substantial presence test 183 days begin counting days on 01-01-2022.

Web Our tax calculator stays up to date with the latest tax laws so you can be confident the calculations are current. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Web The answer is yes J-1 visa holders can receive tax refunds just like their US.

Your household income location filing status and number of. Web Web The answer is yes J-1 visa holders can receive tax refunds just like their US. The tax percentage withheld.

All you need is your W2 and whatever other documents apply to you. Whether you will receive a USA J-1 tax refund depends on the status. All non-residents must pay 10 on any income tax up to 11000.

After that if you are more than 183 days within the US. Web Just grab a calculator and knock it out in a few hours or less. As Nonresident Aliens J-1 exchange visitors must pay federal state and local taxes.

Web Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Setting Up Tax Information

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

The Complete J1 Student Guide To Tax In The Us

Paying Foreign Employees In China Individual Income Tax China Briefing News

Usa Tax Refund Calculator

Tax Calculator Eca International

How To File J 1 Visa Tax Return 101 Tfx

Us J1 Tax Refund Calculator Taxback Com Youtube

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

Everything J 1 Visa Holders Need To Know About Taxes Nova Credit

How To File A J 1 Visa Tax Return J1 Visa Taxes Explained 2023

What Is Fnd Pdf Internet Explorer Microsoft Excel

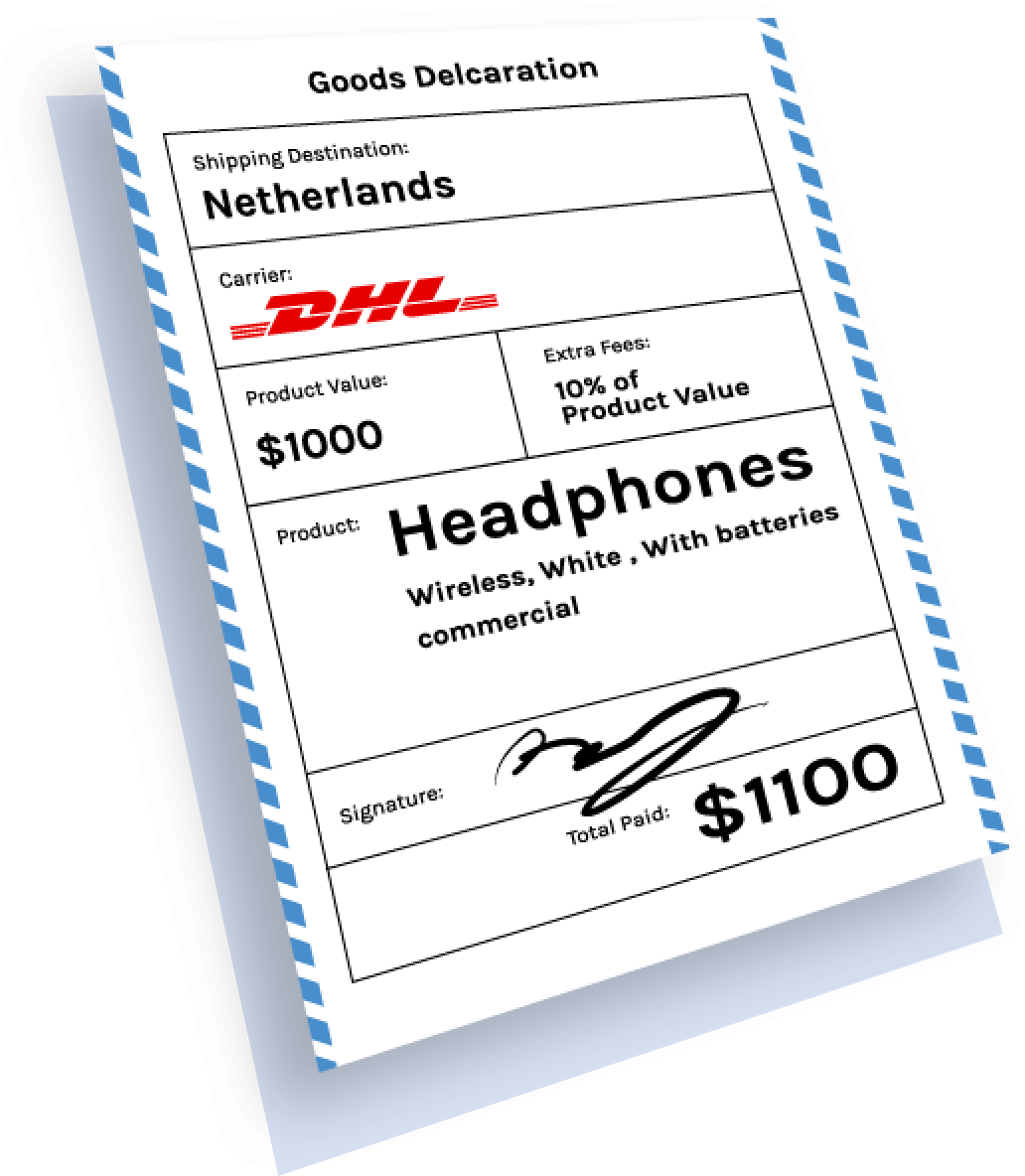

Free Duties And Taxes Calculator United States Easyship

The Complete J1 Student Guide To Tax In The Us

Planning For A Great Financial Future The Savvy Scot

All About F1 Student Opt Tax F1 Visa Tax Exemption Tax Return

Us J1 Tax Refund Calculator Taxback Com Youtube